goPayroll provides our Fiji customers with a number of options for paying additional superannuation contributions:

- you can increase the contribution percentages in the employee's FNPF tab

- you can add a benefit paid by the employer for extra FNPF (as an amount or percentage of earnings)

Increase the percentages

If the employee rate exceeds 8% or the employer rate exceeds 10% then the extra value calculated will appear in the "extra" columns of the FNPF schedule.

In this scenario, the extra amounts contributed do not affect taxable or other calculation values.

Fringe benefit

The employer is paying an additional percentage or amount into the employee's FNPF.

You might use this as an incentive for the employee, or it may be a negotiated part of their salary package (commonly known as a salary sacrifice to superannuation).

- If it's an incentive, then it doesn't affect anything else in the employee's pay.

- If it's a salary sacrifice, then you'd work out the wage rate or salary excluding the value of the benefit (making the taxable earnings less than they would otherwise be which reduces tax and the normal employer contribution)

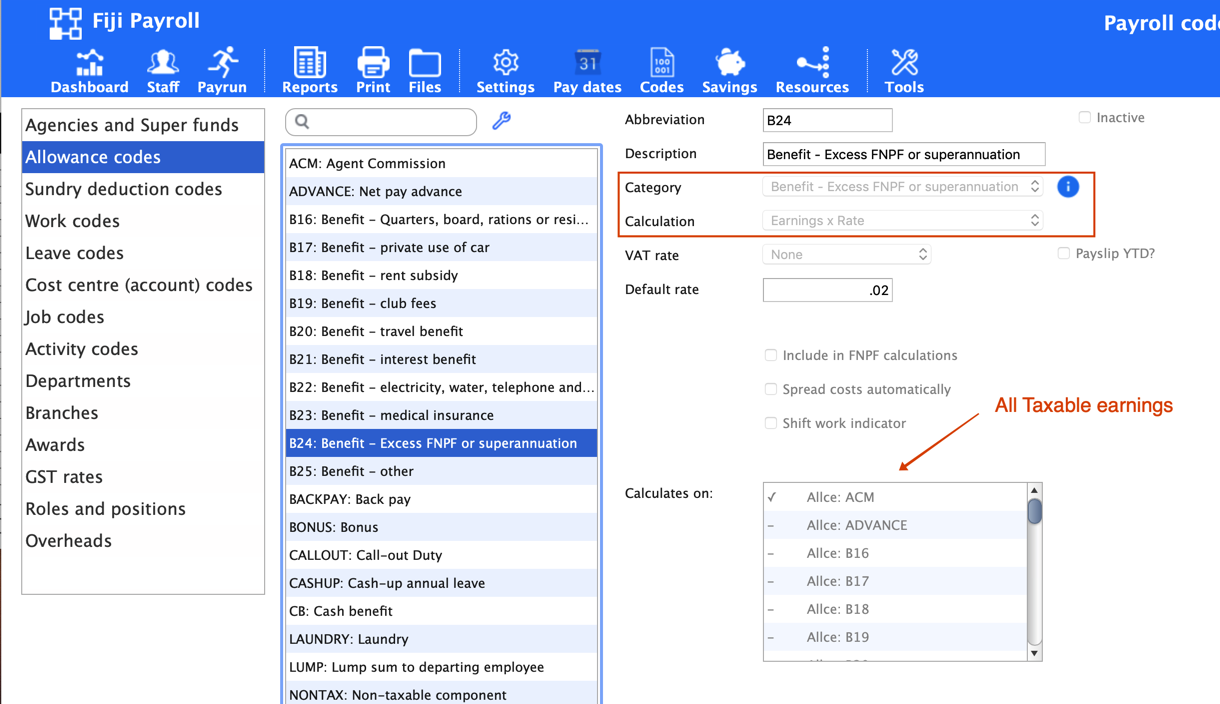

The setup of an example benefit to FNPF is as follows:

Step 1. Make sure you have a correctly classified allowance code

FNPF benefit example - make SURE it is classified correctly and if you base it on earnings rather than an amount per pay make sure to select the items it calculates on

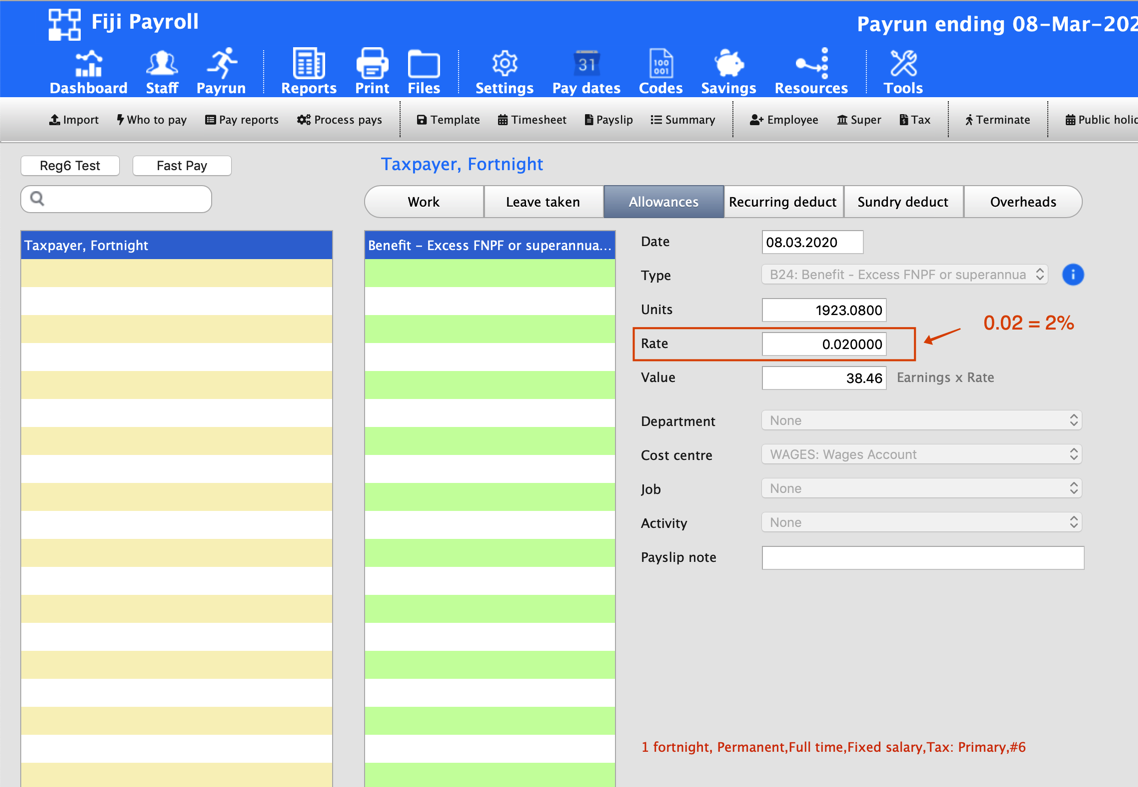

Step 2. Add the fringe benefit allowance to the employee's pay input (and save as part of their template if it is to apply indefinitely)

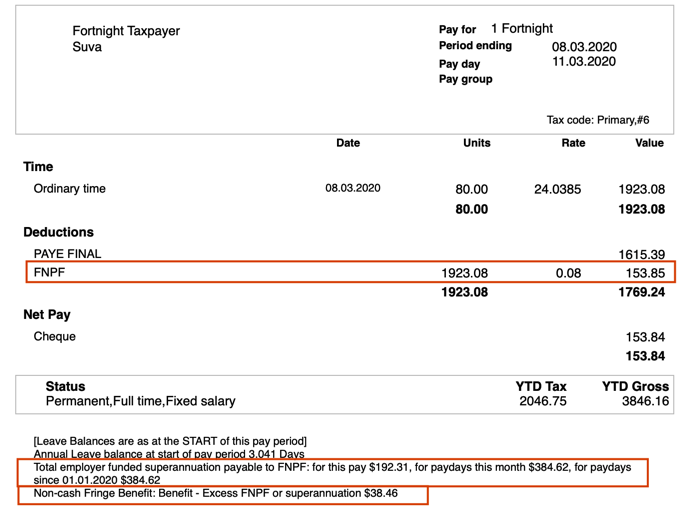

Step 3. the payslip will appear like this

- you can see on this example payslip, the employee's contribution of 8% as a deduction, the employer's 10% contribution and MTD and YTD totals, and the benefit amount.

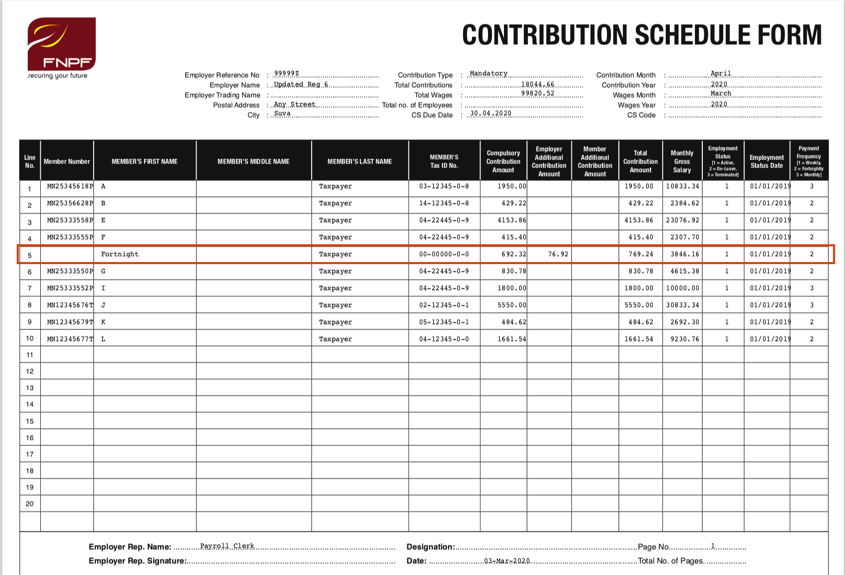

Step 4. The FNPF schedule will show the additional amounts (if any)

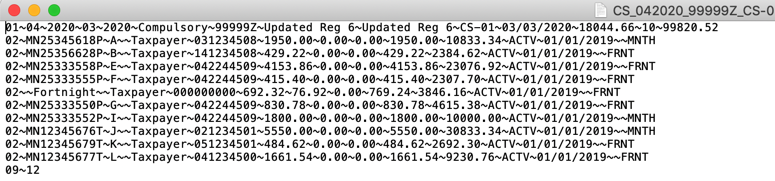

... and the electronic reporting file will contain the extra values

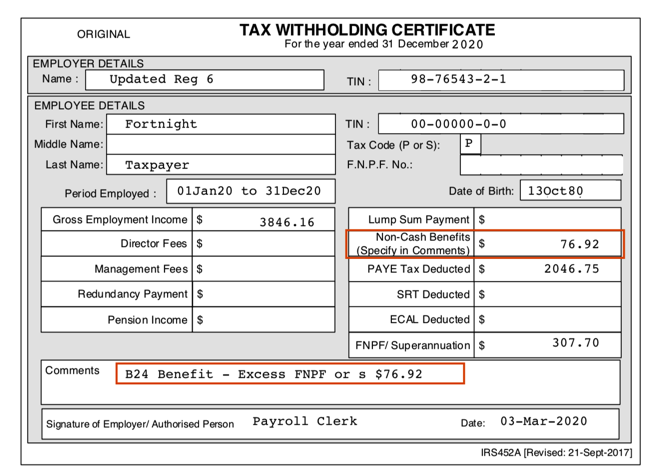

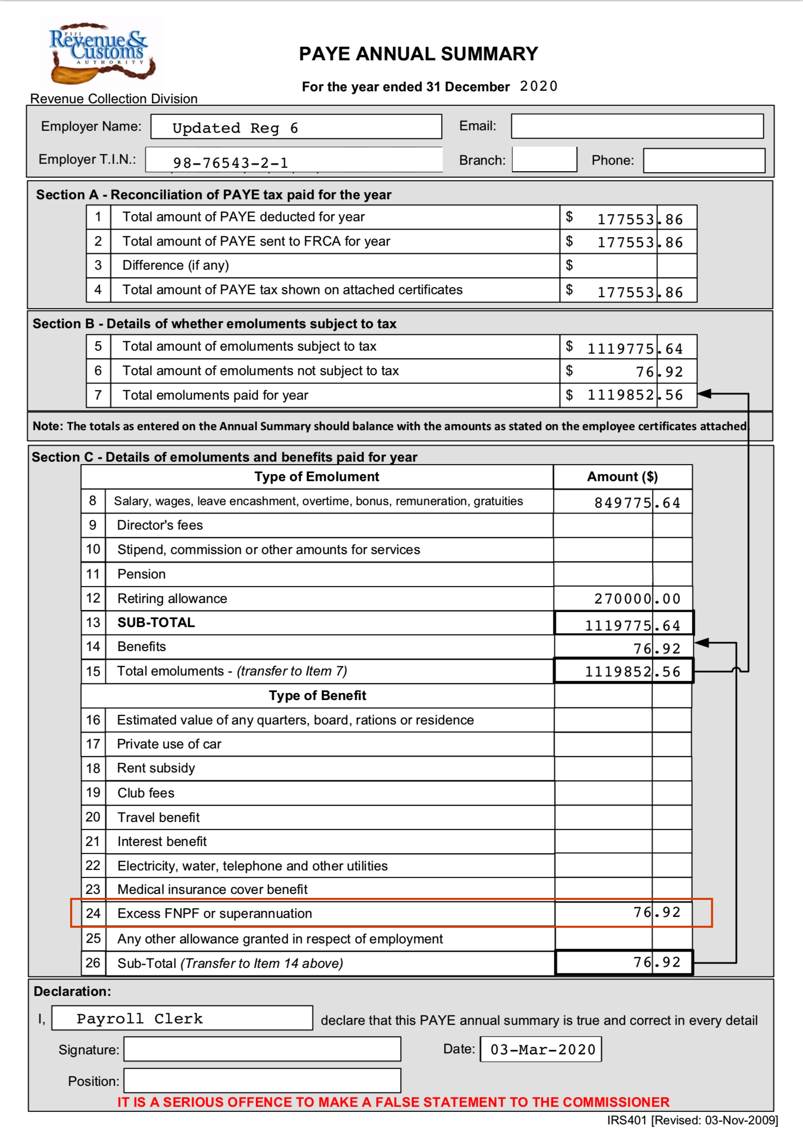

FRCS Reporting: The benefit method means the payment is not paid directly to the employee and is not taxed (it is paid direct to FNPF). Benefits are reported on the employee's tax certificate and on the PAYE Annual Summary.

Further reading