A Settlement Agreement can occur when an employer and employee agree to resolve issues arising from the employment relationship due to:

"Humiliation, loss of dignity, injury to feelings and loss of any benefit"

The settlement may be an order issued by the ERA or court, or an out-of-court settlement.

Payments made pursuant to s123(1)(c) of the Employment Relations Act 2000 are (generally) not regarded as income and not subject to PAYE (ruling available here).

Be aware that such payments may be scrutinised by IRD, especially where such payments exceed $15000 or the payment is deemed a sham, and the employer may be compelled to pay PAYE on the amount.

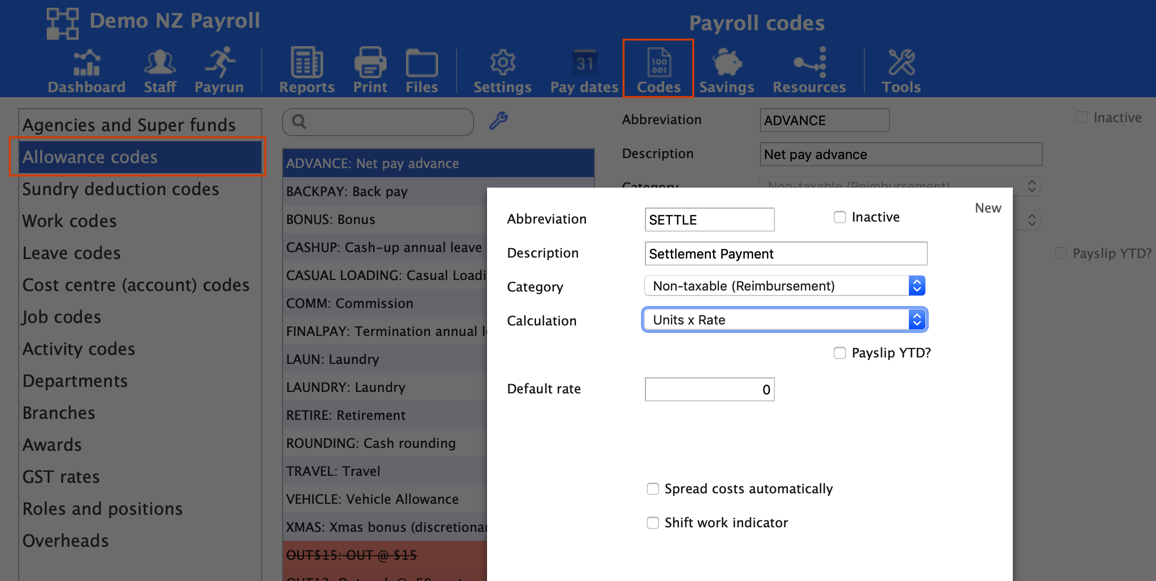

To process a settlement payment in SmoothPay, create an allowance code per this example:

Then add the allowance to the employee's pay for the amount agreed (or you may pay in instalments).

Alternatively this payment could be made from your creditors system (outside of payroll - as it really has no tax, super or earnings implications for the employee).