goPayroll provides comprehensive support for seasonal and piece-rate workers, inluding piece-rates (as allowances), capture of Paid Rest Breaks and Total Hours Worked and can automatically calculate the topup required to ensure the employee is paid at least the minimum hourly rate. It also provides for Seasonal Worker Superannuation remittances (SWSAS).

A complete guide is available here.

The allowances, paid rest breaks and total hours worked can all be captured and edited manually, or preferably imported from a properly formatted time transaction file (each line includes the employee's badge or code and the relevant paycode, units etc.)

Piece-workers in New Zealand are typically paid for each unit of production (as opposed to an hourly rate). This could be per bin of fruit, a number of vines, sheep, etc.

"Pieces" are normally paid using the Allowance/Piecework section of the pay input (and more often than not are imported from a properly formatted CSV file or attendance system such as Vinea) and each transaction is able to be separately costed to a GL cost centre, job, activity or department - great for proper cost analysis.

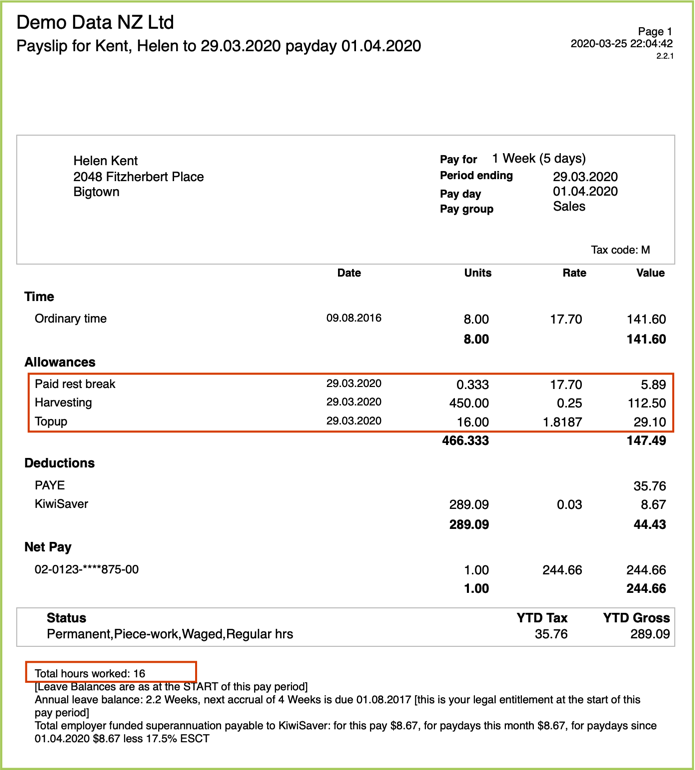

These employees tend not to have paid breaks (because they're being paid for production, not drinking tea), so a Paid Rest Break allowance category is available to record that data (minimum 10 minutes [0.167 hours] per 4-hour period, or 20 minutes [0.333 hours] per 8 hour period). PRB is recorded in hours as a total for the pay period, or individually per day if preferred. It also magically gets paid at the employee's average pay rate for the pay period.

In addition, you must record Total Hours Worked per pay period to ensure that the employee is being paid at least the minimum hourly rate.

Example: So, an employee could be paid $2.50 for crutching a ewe, but take 4 hours to do it [this is just an example] - they'd be entitled to an entry of 1 ewe at $2.50, THW would be 4 hours, therefore they'd be entitled to a PRB of 0.167, and a topup of around $68! [using a min rate of $17.70]

Heres an example payslip showing all relevant items:

Setup

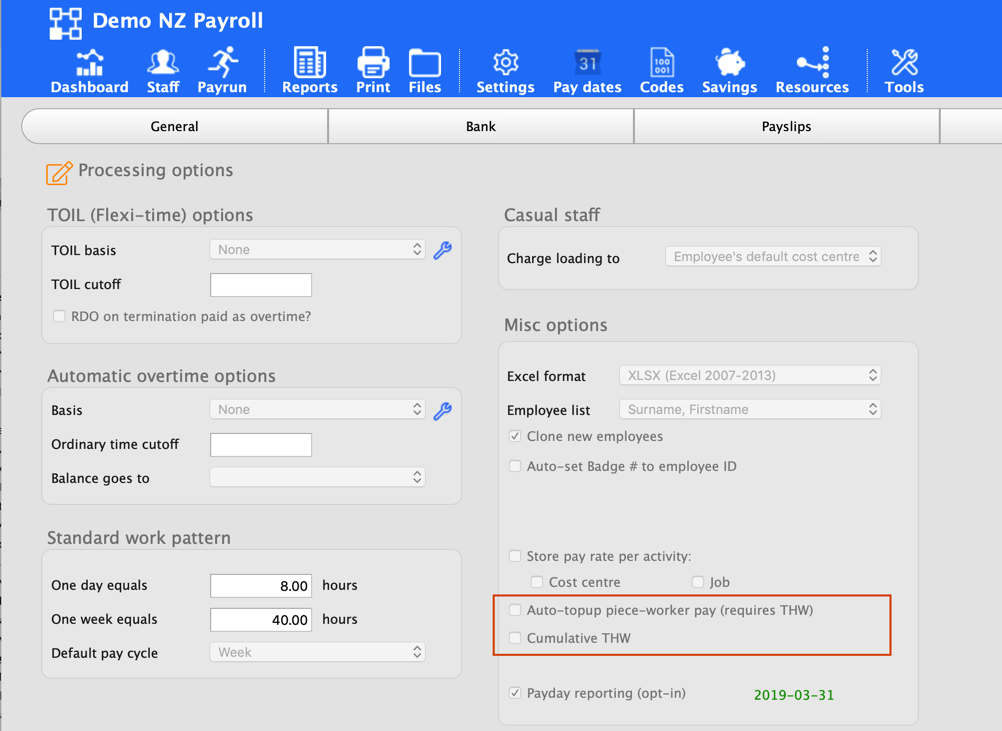

In Settings..Options, set the Topup options as required:

- Auto-topup piece-worker pay: lets the system auto-calculate topups based on total hours worked for the pay period (THW is captured/edited in the Summary tool during your payrun)

- Cumulative THW: allows for the import of multiple THW transactions (from CSV or other attendance system) that accumulate to make the total THW recorded for the pay period (you *may* have THW recorded per day for example, however the total for the pay period is required for the calculation to be performed correctly)

It's fine if the employee also has paid hours etc for different duties - it's all taken into account (excepting extra pay and leave amounts) for the topup calculation to produce a topup amount, if any.

You'll also need an allowance code for each of:

- PRB: Paid rest breaks - make sure the Category is set to Paid Rest Breaks!

- TOPUP: Topup, make sure the Category is set to Topup!

Make piece-work easy

Check out the following:

- Vinea - a purpose-built vineyard and orchard management solution

- FlexiCSV - for those who want to create the ultimate in flexible data capture and speedy import to goPayroll

- RSE guide - our guide covering seasonal and piece-work employees, SWSAS and more.

*end*