Latest news

August 2021

The Wage Subsidy Scheme is available nationally to help eligible businesses continue paying staff and protecting jobs.

For a full-time employee the subsidy is $600 per week and $359 for part-time employees (under 20 hours).

Here is a guide supplied by IRD concerning the different business support measures currently available:

Quick how-to:

- If your employee has worked or is taking leave you must pay them for their time at usual rates.

- If your employee usually earns more than the subsidy, but hasn't earned that amount using work or leave payments:

- top up to the subsidy value using an allowance (e.g. Covid wage subsidy)

- If your employee usually earns less than the subsidy:

- top up to their usual earnings using the same allowance code (e.g. Covid wage subsidy)

- If the employee still hasn't reached 80% of their normal income, recommended where possible, you should pay an additional allowance (e.g. topup not worked) to reach that level

- If you wish to topup to 100% instead, then again you'd generally use a topup not worked allowance

Paying your staff - the official guide

WINZ have published this page to help you follow the process:

**IMPORTANT**

If you are in any doubt whatsoever then you should direct your enquiries to WINZ and/or employment.govt.nz

You should seek HR advice before making any changes to an employee's terms of employment - you cannot unilaterally make changes to someone's pay or conditions.

Here is the specific link on this topic:

Here is the overarching link:

The older articles below provide additional background and are retained more for posterity than advice.

Older articles - March 2020

What subsidies are available?

The following information has been gathered up and presented since the pandemic began and parts are now quite dated, but retained to provide background and suggestions for paying staff when subsidies are available. You should always consult with relevant authorities if you have any questions.

2020: There are two different wage subsidy schemes (so far) - one before and one after 4 pm 27 March. They both have different conditions. Note that on the WINZ website in the FAQ it has the below question.

As an employer, if I have already received a COVID-19 Wage Subsidy for an employee, do the new obligations of the COVID 19 Wage Subsidy (after it was modified on March 27 2020) now apply?

No. The obligations for the COVID-19 Wage Subsidy remain the same as at the time you applied.

Up to 4pm on 27 March

Wage subsidy- you must strive to achieve job continuation and pay at least 80% of the employee's "normal" wages (even if it's more than they normally earn) - there is no requirement to pass the subsidy on to the employee if it's more than the 80%.

Leave subsidy- this is a 14-day flat rate subsidy which must be passed to the employee in full. It's for staff who cannot work from home and need to self-isolate due to recent overseas travel or who have contracted COVID-19 or caring for someone with COVID-19.

From 4pm on 27 March

Wage subsidy- you must strive to achieve job continuation and pay at least 80% of the employee's "normal" wages and no less than the subsidy provided by WINZ for that employee (even if it's more than they normally earn)

Clarification from the beehive 28 March:

“But to be absolutely clear if a person’s income is normally less than the subsidy they can be paid their normal salary."

Just one subsidy now remains. Recent business.govt info indicates that this "Updates and modifies the earlier COVID-19 wage subsidy and leave schemes" but then goes on to say that subsidies paid under the earlier scheme "they are required to continue to use that funding to pay employees for the full 12-week duration as agreed to in the initial application".

https://www.business.govt.nz/news/covid-19-latest-news-and-updates says "If you are receiving the COVID-19 Wage Subsidy, you must try your hardest to pay the employee named in your application at least 80% of their usual wages. If that isn’t possible, you need to pay at least the subsidy rate (ie, full-time or part-time).

If your employee's usual wages are less than the subsidy, you must pay them their usual wages. Any difference should be used for the wages of other affected staff - the wage subsidy is designed to keep your employees connected to you."

More detailed information around these subsidies is available here:

- https://www.employment.govt.nz/about/news-and-updates/workplace-response-coronavirus-covid-19/

- https://www.workandincome.govt.nz/online-services/covid-19/declaration-wage-subsidy.html

- https://www.business.govt.nz/news/covid-19-latest-news-and-updates/

Calculating 80% (or 100%) and paying staff

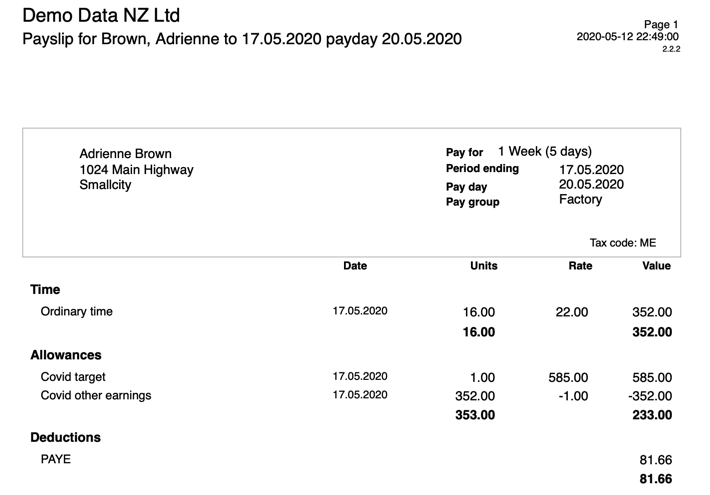

Create and use allowance codes

To aid in potential future audits we suggest creating allowance code CovidWage (and CovidLeave if you have drawn from that pool prior to 27 March) - set as a normal taxable allowance. Use these instead of your usual pay inputs.

Use Codes..Allowances then click [+] to add the new code(s).

Some employers are splitting payments using a variety of codes, such as:

- one code for the subsidy amount (e.g. $585)

- another code for the topup to 80% (e.g. employee normally earns $1000, then topup to $800 would be $415 at employer cost)

Others are simply using the Covid allowance code for the entire 80% calculation:

- Covid, 0.8 x $1000 = $800 (which is probably more obvious than the next example), or

- Covid, 1 x $800

You might also wish to add in the remaining 20% using another code, or add it to the CovidWage total to make up the balance to 100% (or use annual leave available with the employee's consent - if you use this method then take the value, divide by hourly rate to produce leave hours).

Employee has actual work hours

Record time worked as usual.

Where an employee is working (e.g. essential services, or able to work some hours from home) then unfortunately MBIE have provided little to clarify the issue, so you should choose one of the following methods (in lieu of actual good advice and a methodology from MBIE or WINZ):

- deduct the value of time worked from 80% of earnings and pay the difference as CovidWage (or to the value of the subsidy if you can't afford the topup to 80%), or

- deduct the value of time worked from 100% of earnings and pay 80% of the difference (or to the value of the subsidy if you can't afford the topup to 80%)

The method you choose to use is up to you, though we suggest for simplicity just use one code for the entire payment (excl Work, Annual, Sick, Public leave etc. which must still be recorded correctly).

Other bits you need to know

- you need to determine what 80% would be (and MBIE are silent on the matter...which is no help to anybody) - we suggest using Holidays Act weekly values as your guide (right-click the employee's name and choose Leave Balances, or use the Print tool menu in Staff..History to produce Holidays Act Averages), though we expect some employers will be constrained to pay the employee's current contract value, and use that as the basis of the 80% payment to that employee for as long as it takes.

- Note, if the subsidy is more than the normal pay, then pay the normal pay instead.

- If your employee is entitled to a payrate increase at 1 April (minimum payrate increase) then you'll need to reassess the 80% at that time

- Staff do NOT have to use any current sick or annual leave up first, though they may request topups from that source on request.

- Days Paid: You still need to capture days paid to comply with the Holidays Act. IMHO you would capture 4 days (or 80% of normal days paid) and if topping up from employer or leave sources then 5 days (or 100% of normal days paid)

- If you can't afford to top up to 80% then you must pay on the subsidy amount (or the employee's usual pay if less than the subsidy)

Automating the topup calculation

Yes, you can automate the calculation of topup to your target value (e.g. to 80% or the Covid subsidy value, whichever you can afford). Do this only if you fully understand how it works.

- You'll need 2 allowance codes

- one represents the Target value (e.g. $585 or the 80% of normal target value)

- another representing the value of all other payments being made, incl Ordinary, Leave etc. - this code must have a calculation method of Earnings x Rate and will be based on all taxable earnings codes except the target allowance.

- Add both codes to the template pays for all staff you expect to topup. Set the target value and use the rate -1 for the other payments code then save as the template pay.

Now, whenever you add in Ordinary time, or Public Holiday etc., the value of those entries will calculate a negative value other payments allowance.

NOTE: if the negative value exceeds the target value then you must delete both from the pay, as the employee is entitled to be paid in full for leave and time worked.

Are the payments to staff taxable?

Yes. IR have advised us that these amounts are paid to replace taxable income, so are subject to tax as usual (not Extra Pay tax).

What about sick leave and public holidays?

Public Holidays and Sick leave are still subject to the rules provided by the Holidays Act (you either "know" what an employee would have earned, or you don't and need to pay ADP)

Public Holidays falling due within the subsidy period are payable as usual (as far as we know).

What about annual leave?

Annual leave is still subject to the rules provided by the Holidays Act.

IRD's COVID-19 information

...and this guide from their site covers tax and super information for payments to staff...

IR have also asked us to supply this information:

If your business is unable to pay its taxes on time due to the impact of COVID-19, we understand, you don’t need to contact us right now.

Get in touch with us when you can, and we’ll write-off any penalties and interest.

It would help a lot if you continue to file however, as the information is used to make correct payments to people, and to help the Government continue to respond to what is happening in the economy.

NOTE: These interpretations and guides are still subject to change as the Govt fleshes out information around these subsidies - if you have any questions PLEASE CONTACT WINZ directly on 0800 40 80 40, or MBIE on 0800 20 90 20