What you need to know before granting a cash-up

As usual there are a number of conditions imposed by the Holidays Act that must be met in order to grant an employee the opportunity to cash-up annual leave.

-

The employee must have accrued leave (therefore you can’t cash-up in the first year, as leave accrues at the end of 12 months service)

-

A maximum of 1 week can be cashed between anniversary dates (though it can be in parts of a week to a maximum of 1 week)

-

The request must be in writing, and your response must be in writing

-

You do not have to allow the cash-up and you don’t need to give a reason

-

The payment is taxed at Extra Pay rates (and may result in a significant amount of the cashed-up value being lost to tax - any excess tax may be claimed as a refund at the end of the tax year) and it does not count towards averaged earnings for Holidays Act purposes.

-

If paid off-cycle it is very likely that the amount of tax deducted will be less than it should be and any shortfall will be payable at the end of the tax year. This is not the employer’s (or Smoothpay’s) problem - it is a consequence of poorly designed NZ tax rules.

WARNING: If you fail to follow the guidelines and get caught then you may be required to reinstate the cashed-up leave paid outside these rules (you would have to pay the leave a second time)

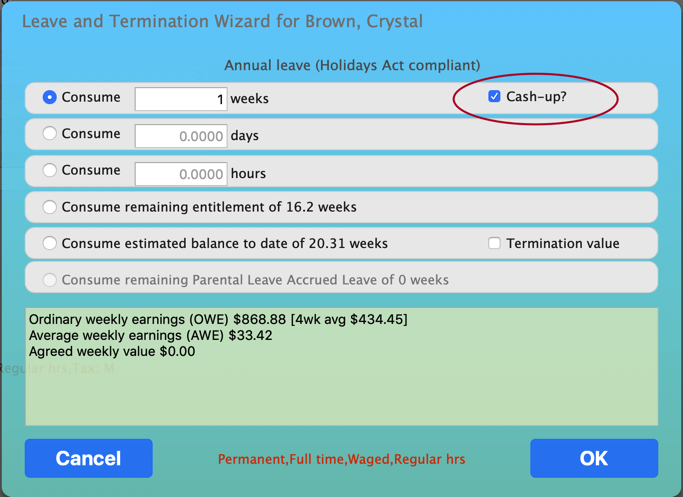

How to process a cash-up

Add an entry using Payrun..Leave Taken and choose the Cash-up option in the annual leave assistant: