If you receive a letter from IRD instructing you to make Child Support deductions from an employee, then check and proceed as follows:

If the notice is issued under Section 154 specifying a percentage of net pay to be deducted (generally only applies to WT taxed employees) then

-

- add the IR bank account to the employee's personal set of bank accounts and specify the percentage method and enter the percentage specified. Make sure the employee's IRD number and any other particulars required by the notice are filled in the appropriate fields (e.g. NCP code as the tax type)

- deductions continue until further notice, then simply deactivate the bank account

- these deductions are paid direct to IRD each pay period - they do NOT get reported or paid via Payday Reporting or the IR345

If the notice is just a normal Child Support deduction notice then

-

- it will specify an amount to be deducted (subject to protected net earnings rules - goPayroll will do this for you automatically)

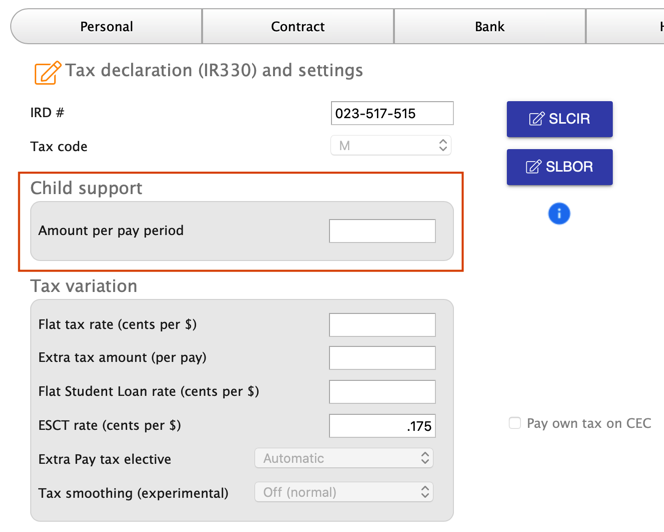

- simply put the amount per pay period in the employee's Tax section (because it's collected along with PAYE, Student Loan and ESCT) - do NOT try to add it as a deduction or agency payment.

- it will be reported to IR in Payday Reporting and is paid when you produce and pay your IR345

*end*