If Centrelink are funding you to provide Paid Parental Leave to an employee, then you need to:

- apportion the amount received into 1 or more normal pay periods,

- deduct tax,

- exclude the payments from accruing any additional annual leave entitlements, and

- there's no need to contribute superannuation on these amounts

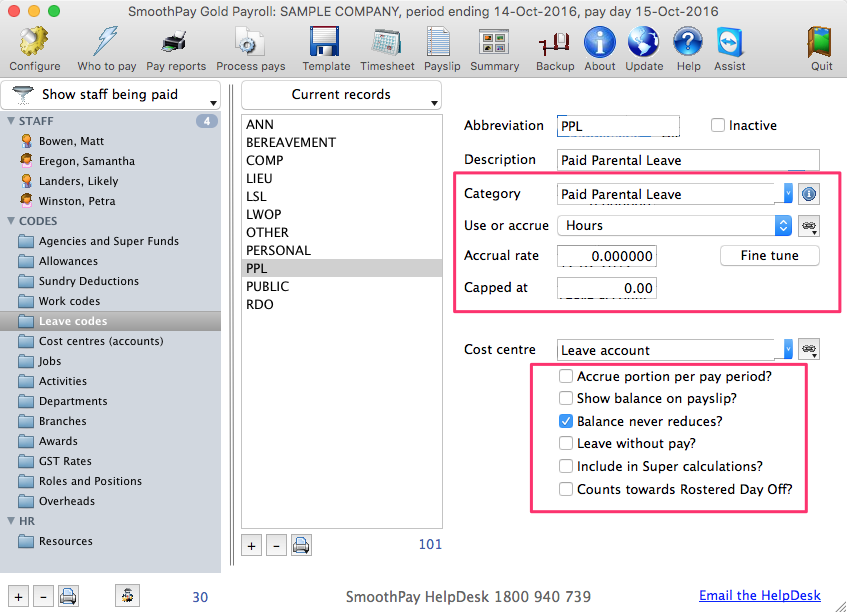

You'll need a "Paid Parental Leave" leave code set up EXACTLY like this:

Then you can "consume" PPL as you would any other type of leave (check the employee's Leave settings in case PPL has been set up differently (e.g. [No entitlement] setting is a common cause for a leave code not appearing in the leave types).

Use the leave code in the employee's pay input (remove any ordinary time entries etc, add the PPL entry to Leave Taken).

The PPL leave type is allowed to be saved as a pay template entry (generally, leave is not saved into the employee's template pay) [added in v3.7.16].

An example:

You have been given $8000 to be paid at $1000 per week.

Each week, enter a PPL entry for 1 unit @ $1000 (if paid fortnightly then 1 unit @ $2000) - normal pay rates and hours don't apply so it's easier just to do it this way. Effectively, it's an allowance you are paying instead of Centrelink.

You must not pay the PPL out as a lump sum - it must be paid out over normal pay periods until the amount given has been consumed

For more information about Paid Parental Leave, please refer to this guide from Centrelink- refer to this guide: Paid Parental Leave Employer Toolkit