JobMaker (and other STP declaration codes)

An extra field is available in Staff..Contract..Misc to cater for the ongoing need for extra STP reporting codes to be submitted to ATO

For JobMaker start and end codes, please see this page.

JobKeeper payments

If you're eligible and wish to claim JobKeeper subsidy for April, you must get all set up by the end of April (extended now to 8 May) and have paid your eligible staff at least $1500 per fortnight for the month (and classified any topups using the topup allowance code described below).

- Enrol and Apply for the JobKeeper payment

- JobKeeper starts for paydays on or after 30 March 2020

- Staff must return completed forms by the end of April, otherwise you are not entitled to JobKeeper subsidy for those staff

- Employers have until 31 May 2020 to formally enrol to claim the JobKeeper payments for fortnights 1 and 2, however, the sooner an employer pays their staff for those April fortnights and enrols, the sooner the ATO can reimburse them the JobKeeper payments.

- ATO have extended the April corrections period to 8 May (by which time, if you're intending to claim JobKeeper for the first two fortnights in April you must have ensured staff were paid at least $1500 per fortnight and reported April JobKeeper via STP)

- SmoothPay provides JobKeeper start/finish fields (Staff..Contract..Misc) - available from 17 April

- Simply tick when the employee has accepted your JobKeeper offer and enter the payday that the minimum $1500 per fortnight started

- Leave the finish date empty - you only use this if the employee leaves or goes on worker's comp, or shift to jobkeeper with another employer etc. before 30 September 2020.

- If the JobKeeper payment exceeds the employee's normal wage (as at 31 March) then the employer does not need to include the excess in super guarantee calculations:

- create a separate allowance code classified "topup (not worked)" - this makes it taxable but not subject to SG and use it to record the amount to bring the employee's pay up to $1500. This will be reported to ATO via STP as JobKeeper Topup.

- The normal STP reporting process will automatically include start/finish and topup information to ATO - you do not need to set up any special codes (other than the topup allowance if payable).

- You must continue to accrue leave as usual for any portion of the pay period that is deemed to be a stand-down (in our Covid-19 article we suggest using a work code, such as Ordinary, or create a new one to record any additional hours for the pay period that have not been worked or paid leave, paid at $0. This causes the usual leave accruals to occur as if the employee had been paid for their usual fortnight). If you prefer, you could just add an adjustment to Leave..History to cover the usual accrual.

- ATO will reimburse you for JobKeeper amounts in the following month

- JobKeeper ends at the last payday on or before 27 September 2020

From 28 September 2020, employers intending to claim should do all of the following:

- work out if the Tier 1 or Tier 2 rate applies to each of your eligible employees and/or eligible business participants and/or eligible religious practitioners

- notify the ATO and your eligible employees and/or eligible business participants and/or eligible religious practitioners what payment rate applies to them; and

- during JobKeeper Extension 1, ensure your eligible employees are paid at least

- $1,200 per fortnight for Tier 1 employees

- $750 per fortnight for Tier 2 employees

- during JobKeeper Extension 2, ensure your eligible employees are paid at least

- $1,000 per fortnight for Tier 1 employees

- $650 per fortnight for Tier 2 employees.

CLICK HERE to read the full ATO announcement.

Making corrections

ATO have advised that the data you submit should be correct as the timeframe available for designing capture of JobKeeper data into STP has left little opportunity for late corrections.

However, it is possible to make corrections to your STP data in some cases.

The most common scenario is:

- starting incorrectly, or started with wrong date, or on Workers Comp and flagged as starting JobKeeper incorrectly

- set the JobKeeper finish date to the same start date, resend the STP report for the last pay

- if the employee becomes eligible, then at that time set the start date to the payday and clear the JobKeeper finish date

Corrections are an ever-changing minefield, so if corrections are required, please call and we'll help out.

Automatic JobKeeper topup calculation

We've been asked (once) why the JobKeeper amount isn't calculated automatically.

Primarily due to the time available for making all the required changes, but also because in only one instance have we seen where this would have worked properly. It seems most sites have additional allowances, loadings and sacrifices and the occasional paid parental leave and workers comp, all of which impact on the JobKeeper topup (if it's even required).

So, short answer is, no - you need to calculate the topup value yourself (if any), however if it suits the way you're applying the topup then you could try the following method:

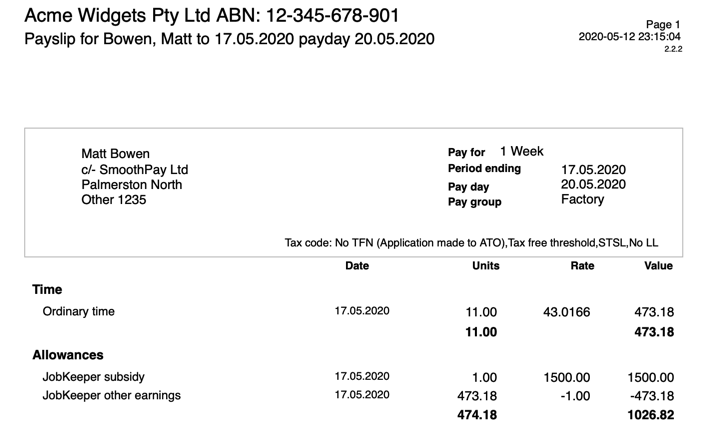

Automating the topup calculation

It is possible to automate the calculation of topup to your target value (e.g. to $1500). Do this only if you fully understand how it works.

- You'll need 2 allowance codes, both using the category "Top-up (not worked)" so that they offset each other when reported via STP.

- one represents the Target value (e.g. $1500)

- another representing the value of all other payments being made, incl Ordinary, Leave etc. - this code must have a calculation method of Earnings x Rate and will be based on all taxable earnings codes except the target allowance and anything outside the scope of the subsidy rules.

- Add both codes to the template pays for all staff eligible for topup. Set the target value and use the rate -1 for the other payments code then save as the template pay.

Now, whenever you add in Ordinary time, or Public Holiday etc., the value of those entries will calculate a negative value other payments allowance.

NOTE: if the negative value exceeds the target value then you must delete both from the pay, as the employee is entitled to be paid in full for leave and time worked.

If you're not sure of anything, feel free to ask.

Additional resources: