An employee may request up to 2 weeks of their annual leave balance to be cashed out (cashed up) in any 12 month period, as long as:

- the request is made in writing (you do not have to approve the request), and

- their award or agreement permits leave to be cashed up

- the amount paid must be the same as if they had taken the leave (including leave loading if applicable, so you'd often use their rate + 17.5%)

- they have at least 4 weeks accrued leave remaining after the cash-up

We strongly advise against allowing staff to cash-up annual leave, as it seriously undermines their hard won entitlement to time off and they lose accrual that would occur if the leave had been taken (in this case approx 5.85 hours valued at $154 and not having time off).

However, should you both agree to the cash-up, proceed as follows.

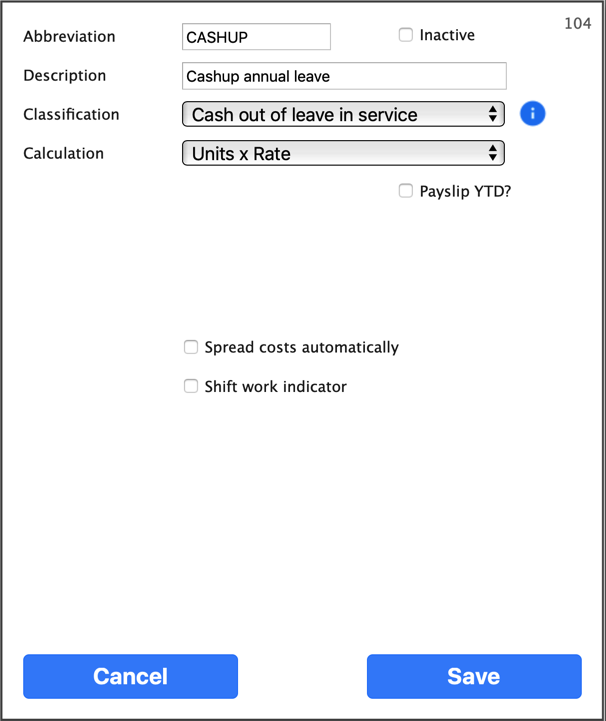

If you haven't already got a CASHUP allowance code, create one similar to this example (or check your existing allowance is set up correctly):

Then, add the allowance to the employee's pay inputs (ensuring that the value is what they would have received had they actually taken the leave, and includes leave loading if applicable). The amount paid is subject to Super and will be taxed using standard tax rules.

Following the payrun you will need to manually adjust the employee's leave balance to deal with the cashed-up leave (add an adjusting entry to their Leave..History, for example: -76 hours and describe the reason for the adjustment in the comment section).