Salary sacrifice is fairly common practice in Australia, but not in many other countries (PNG allows sacrifice to super, most other countries do not provide for it at all).

NZ has a commonly-termed Salary Sacrifice too where the employer basically includes CEC in the employee's salary package instead of paying it on top, along with another option to pay ESCT as extra PAYE to maximise the benefit going to the employee's fund.

Australia

The rules for Australia are fairly straight forward:

Extra employer contributions to employee super

It is common practice for employers to topup contributions to an employee's super fund at the end of the year. Essentially, this is a sacrifice of extra income to superannuation.

The simplest method is:

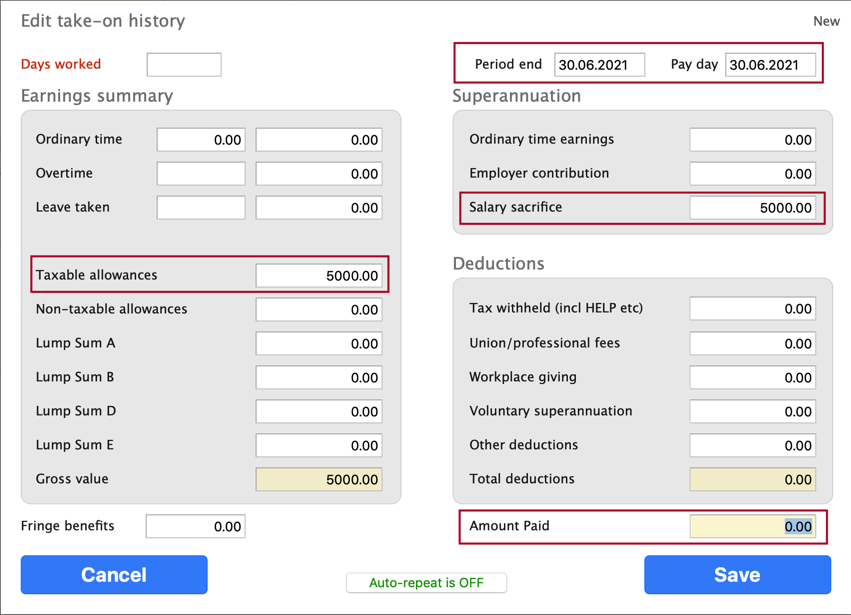

- add a manual Pay History record dated on or before 30 June

- enter the topup value as Taxable Allowance

- enter the same value as Salary Sacrifice

NOTE: You must ensure the employee's total sacrifice does not exceed the annual threshold (they *may* have been sacrificing other income)

When you run your SuperStream submission for the month or quarter ending 30 June, the amount will be included in the payload. If you have already paid to the fund manually (you really shouldn't) then it can be excluded from the submission by entering a pre-payment amount in the employee's Super tab.

There is another method, but a little more effort is required:

- add a taxable but non-superable allowance to the employee's pay input

- enter a matching sacrifice value in the employee's Super options

- process the payrun

- remove the sacrifice value from the employee's Super options

Novated leases

Novated leases are also easy to set up - see this guide for details.

Papua New Guinea

Refer to the Salary Packaging section in our PNG Payroll Guide available here.

Solomon Islands

The Solomon Islands for example do not have any provision in legislation for sacrifice (even though you can set it up - it may not be permitted by the relevant tax authority):

We can show you how to process salary packaging in SmoothPay for Solomon Islands, however it is my opinion that S5 Income Tax Act excludes any kind of pre-tax deduction (including education), and that your employee may well end up having to pay additional tax at the end of the year.

Such practices are permitted under Australian law, however we have yet to see any such provision for the Solomon Islands (and we checked the Income Tax Act to be sure). Their website is very light on details of exemptions (Nil) and does not consider ex-pats etc at all, so some official guidance is needed.

New Zealand

Often termed "salary sacrifice", the employee is basically agreeing to have the employer's CEC counted as part of their salary package, instead of being paid on top.

Essentially, the employee is agreeing to be paid less, and to potentially pay a little less tax.

In goPayroll, the employee's salary "package" might be $60000, however the real salary paid (assuming a 3% CEC) will be:

- 60000 / 103 * 100 = 58252.43 which is entered as the employee's salary in their Contract settings

- The employee is therefore taxed on the lower income (taxed on $58252.43), unless they also elect to pay ESCT as PAYE (taxed on $60000).

An employee can elect to pay the ESCT as part of their PAYE. ESCT is based on a rate set at the start of each tax year, and that portion of the CEC is normally lost as ESCT to IRD.

Paying your own ESCT as PAYE has two benefits:

- the extra tax paid *may* be less than the amount that would be lost as ESCT (the CEC is re-added to your gross earnings before tax is calculated). If the ESCT rate is 30% but your average tax is 25% then it's a win.

- the employee's super fund receives 100% of the CEC amount "sacrificed", making the most of your Kiwisaver investment by growing it faster.

This option is available regardless of CEC being bundled into a "salary package".