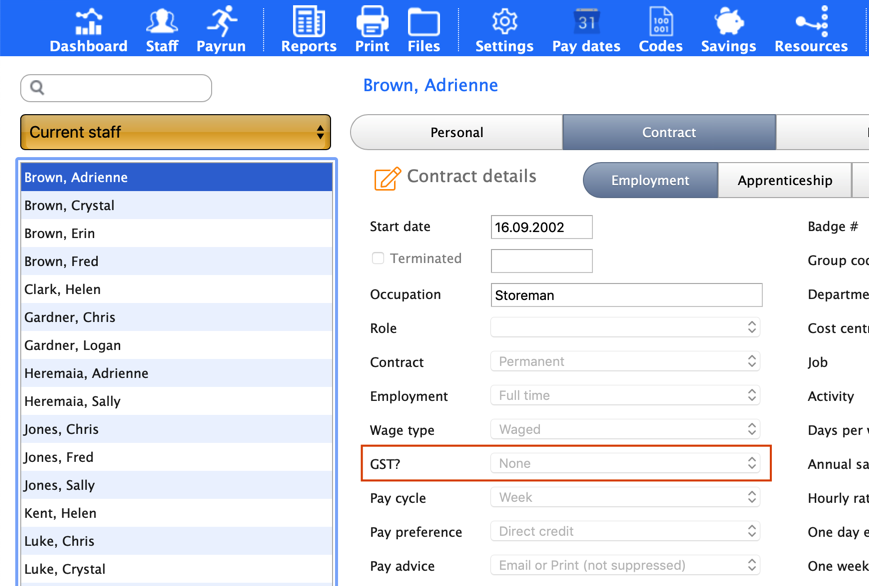

SmoothPay caters for contractors/agents who may have requested tax to be deducted from their payments (in NZ use tax code WT and set the tax rate from their completed IR330C), and you can produce payslips showing GST or a Buyer Created Tax Invoice (settable per employee).

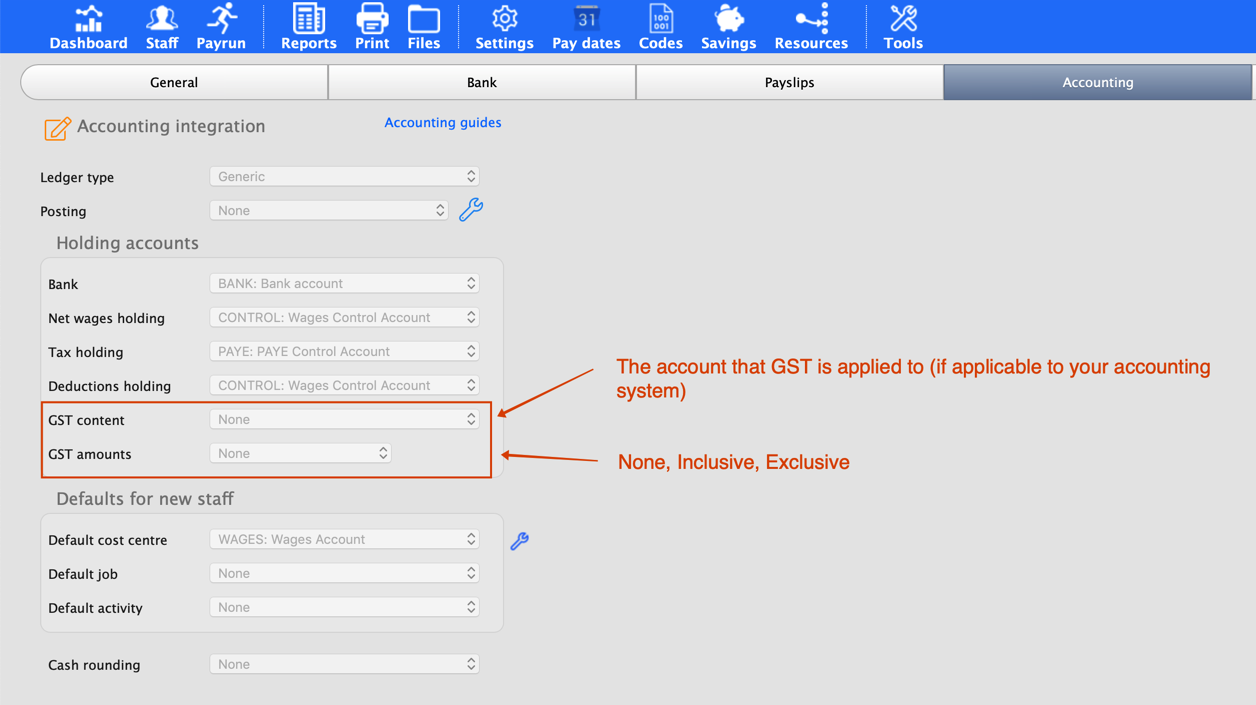

You control how GST is to be catered for (for accounting purposes) in [Settings].

There are options to treat amounts entered as inclusive or exclusive (depending on how invoices are generally presented). The end result is the same either way.

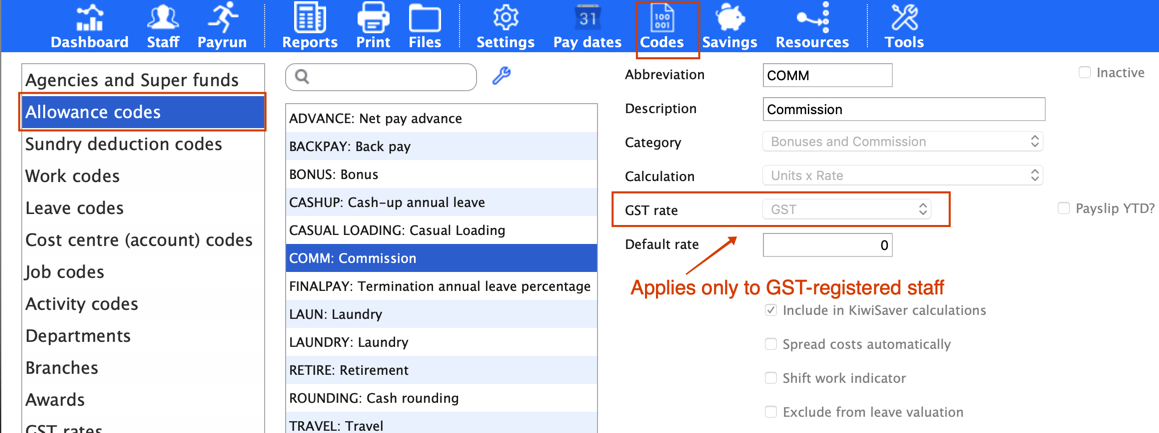

Each Work and Allowance code can also be set to attract any of the prevailing GST rates (set in [Codes..GST]) or not - these only affect GST-registered staff.

GST rates can be set/changed in Payroll Codes - these should already be correct (e.g. 15% for NZ)

Set the employee up as a contractor with relevant tax code and rate, set their GST option to GST on Payslip or Buyer Generated Tax Invoice (depending on whether he gives you an invoice or you are going to generate one on his behalf).

Related articles